I account for every dime I Spend

Financial power or shall I say freedom, is something I yearn for. To be debt free would bring me such peace of mind. I remember sitting in my undergraduate elective class “Personal Financial Decision Making” my senior year in college. The course was an all day, one week long class for credit held over during the holiday break. Its core focus was to teach us how to take control of our financial future. My finances at that time were in shambles. I’d done what most college students, I’d gotten credit cards from the different companies that hover over campuses like vultures waiting for the next broke student to apply and take their free t-shirt. This class was about to teach me something I’d cherish for a lifetime.

The course was exciting and filled with tips on how to save for retirement, purchasing a new car vs. used, paying credit cards, etc. The course introduced me to Suze Orman , the financial guru. She became my personal financial expert (at least in my mind), and she was only a channel click away. This was over a decade ago and at the time she had a TV show that I stayed tuned to. The main take away from both sources was learning to live within my means. Credit cards weren’t bad, the way I’d been using them was. I saw the importance of how my savings could make a huge difference in my future financial lifestyle.

I began working on ways to raise my credit score. I started paying attention to how my hard earned money was being spent. This process revealed opportunities to cut back. My daughter was a baby at the time and I knew we’d eventually want to move from our apartment to a home. It became important to me to set example to my child about how to properly spend money, get the things you need first and foremost and decide if the things you want are important. I took this approach to every paycheck I received, accounting for every dime spent.

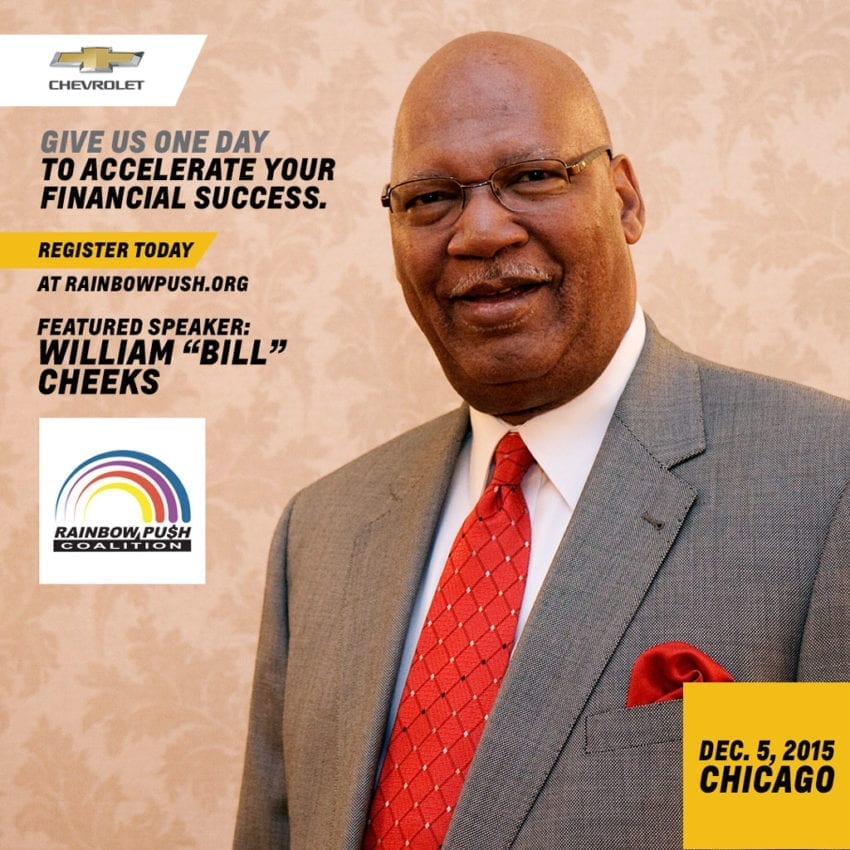

Once my husband and I started financially planning together, my skills became a norm for the household. I’d cut where I saw we were wasting money, and invest in other areas. This led us to saving for our wedding and purchasing our first home. The one thing I’ve learned over time is that you never stop educating yourself. This is why I am so excited to attend the Money Matters Financial Empowerment workshop hosted by Chevrolet and held at the Rainbow Push headquarters here in Chicago on 12/5/15. This is a FREE one-day financial workshop that will inform and empower you to claim your financial success. Please join me to learn about investing, building your credit, building wealth, and budgeting basics, RSVP today at http://rainbowpush.org. #PUSHMoneyMatters workshop seeks to boost your financial literacy and promote financial planning, two things that help make life financially easier. I hope to see you there. Expect to see me there and I’ll be sure to post an update for my readers after the event with some savvy financial advice from the professionals.

Good for you! My husband had us do this for a few years when our children were little. I have to admit I didn’t love it! 🙂 But it was a great way to find out where we could adjust our spending when needed. In the long run, you’ll be glad you disciplined yourself to do this. Blessings!

Thank you. It is a task, but so very worth it!

Good for you. We are working hard to get out of debt, too, and accounting for every penny is an absolute necessity!

yes it is hard. I want to be completely debt free (house, car, student loans) in 5 years. It is a reach, but I think possible.

Such an uplifting story; I’m so happy for you and your husband. How awesome is it that these organizations have partnered to bring the community financial literacy FREE OF CHARGE?!? See you there!

-Dasha

http://windycitywardrobe.com

yes i love workshops like these. You learn so many small tips you can incorporate right away. Looking forward to the day!

Your story is pretty inspiring. Even the best of us can learn a few things about building and maintaining excellent credit. Thank you for sharing.